1693

1693

Overview

This guide helps you troubleshoot scenarios where a client was charged more than expected—such as being billed $51 instead of a $29 trial fee. Often, the extra amount relates to failed payment fees from the payment gateway. Understanding how to check and explain these fees is essential for maintaining client trust.

Prerequisites

- Admin access to Hapana Core

- Access to your studio’s payment gateway account (either Stripe or Ezypay)

- A screenshot or reference of the charge from the client

- Familiarity with your failed payment policy and any associated gateway fees

Step 1 – Check for Failed Payment History in Core

- Log in to Hapana Core

- Navigate to the Clients tab

- Search for the client by name, email, or phone number

- Open their profile and go to the Payments tab

- Look for any failed transactions, which may not result in a completed invoice

Tip: If no charge is visible, the fee may have been imposed by the payment gateway, not by Core itself.

Step 2 – Check Your Gateway's Failed Payment Fee Policy

- Locate your studio’s failed payment fee settings

- Click into the Ezypay Payment Gateway image

- View the amount charged for a failed payment. It will show full breakdown of “Total Amount Charged”

Ezypay Example:

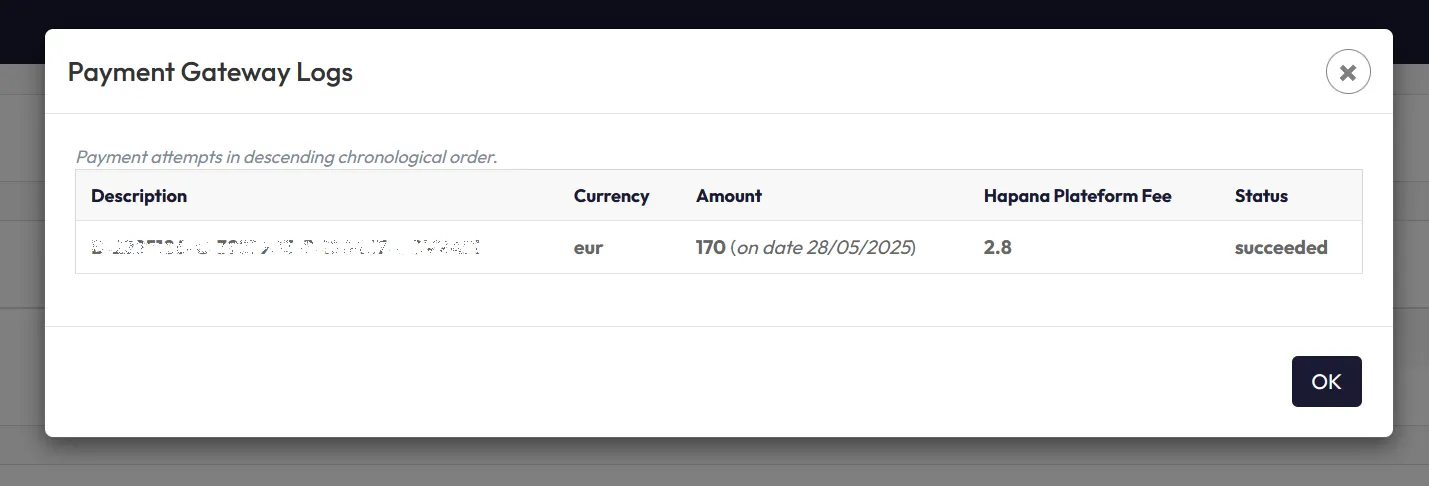

Stripe Example:

Tip: If your gateway charges a failed payment fee and the client had a payment failure before a successful retry, this may explain the extra charge.

Common Reasons for Failed Payments

Even if it looks like a client had sufficient funds, failed payments can still occur due to:

- Pending transactions in the account that hadn’t cleared yet

- The member exceeded their daily debit limit

- Funds were deposited after the scheduled debit attempt

- A minimum balance policy where the account must retain a certain amount after deductions

How to Reduce Failed Payment Risk

- Set the billing date for the day after the client is paid

- Remind clients to have available funds in advance of the billing cycle

- Ask clients to contact their bank if they believe the payment was wrongly rejected

Tip: If none of the common reasons apply, direct the client to their bank’s support team for more clarity.

Expected Outcome

You’ll determine whether a failed payment triggered a fee and be able to explain the total charge. This can help resolve client disputes and avoid future billing issues.

FAQs

Q: Why don’t I see the charge in Hapana Core?

A: If the charge was a gateway-level failed payment fee, it will not appear as a normal invoice in Core.

Q: Can failed payment fees be waived?

A: This depends on your studio’s policy and the payment gateway’s rules. Some gateways may refund on request, others do not.

Q: What if the charge still doesn’t match anything?

A: Double-check with your payment provider and confirm whether any third-party fees were added.

Need help? Reach out to our support team at [email protected]