392

392

Overview

This article explains how to set up Registered Tax settings in CORE — including the difference between inclusive and exclusive tax configurations. This ensures your pricing complies with regional requirements (e.g. GST, VAT, or US sales tax).

🎥 Watch the walkthrough:

Or preview it below:

Prerequisites

- Admin access to CORE

- Confirm whether your business is required to charge tax (e.g. GST, VAT, Sales Tax)

Step-by-step instructions

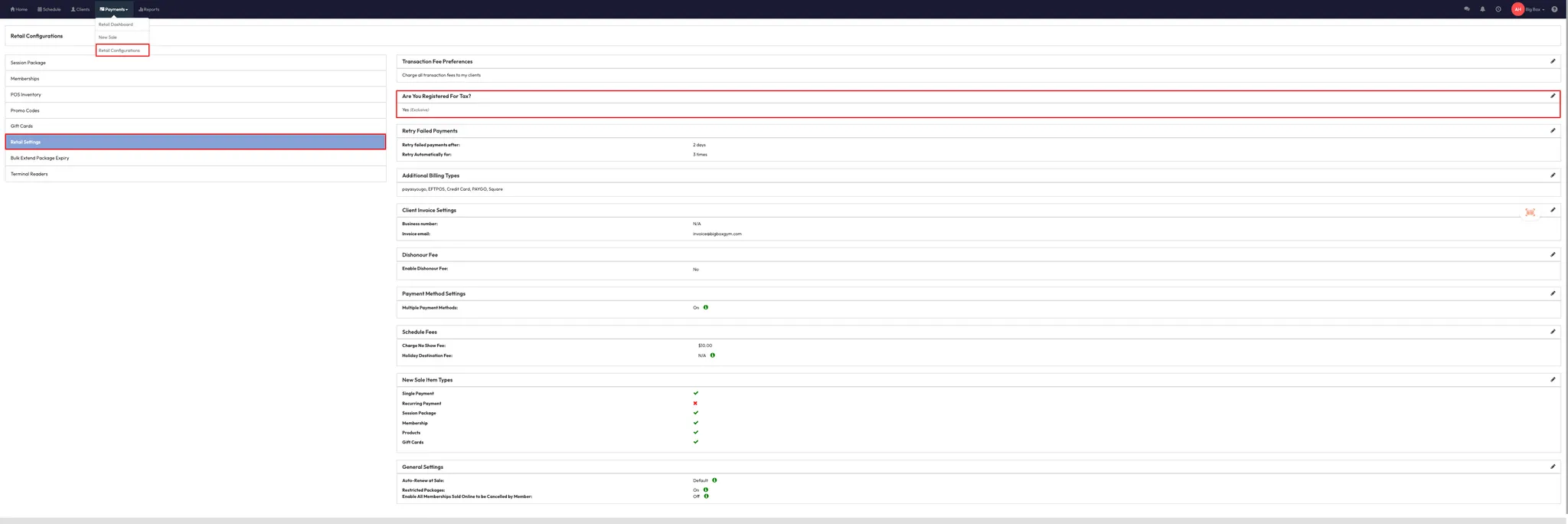

Step 1: Access registered tax settings

- Go to Payments > Retail Configurations > Retail Settings.

- Locate the Registered for Tax section at the top.

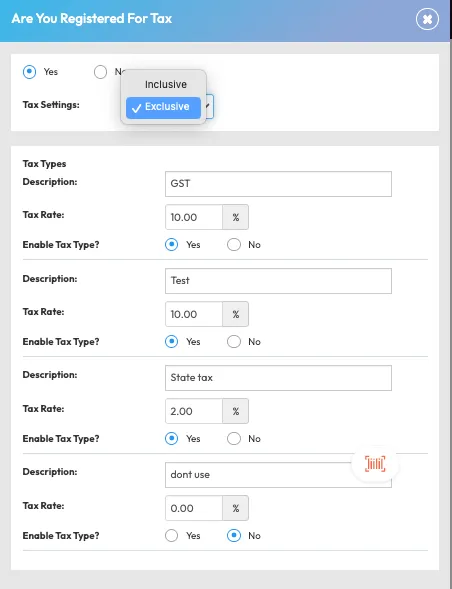

Step 2: Enable or disable tax registration

- If you are not required to register for tax:

- Select No and click Save.

- If you are required to register:

- Select Yes.

- Choose from available tax types (e.g. GST, VAT, US Sales Tax).

- Click Save.

Step 3: Choose inclusive or exclusive tax

You must choose either inclusive or exclusive for your entire CORE account. You cannot mix both types.

- Exclusive Tax:

- Tax is added on top of the displayed price.

- Example: $10 item + 9% tax = $10.90 total.

- Inclusive Tax:

- Tax is included in the displayed price.

- Example: $10 item = $9.10 net + 9% tax = $10 total.

Tip: Exclusive pricing is common in North America. Inclusive pricing is standard in places like Australia and the UK.

Step 4: Add or manage multiple tax types

- Within Retail Settings, you can manage multiple tax entries (e.g. federal, state, or local taxes).

- Enable or disable as needed depending on location or product type.

Expected outcome

Your account will be correctly configured for tax collection based on your region. Taxes will apply to purchases either as included or added amounts depending on your setting.

FAQs

Q: Can I mix inclusive and exclusive tax across different products?

A: No — you must choose one format for your entire CORE account.

Q: What if I’m unsure which tax type to select?

A: Consult your local accountant or contact Hapana support for region-specific advice.

Q: Does tax appear on receipts?

A: Yes — the tax amount is shown based on your pricing format.

Still need help?

Reach out to our support team via [email protected]