293

293

Overview

We’ve updated how invoices processed through Ezypay appear for standard and failed payments.

With these changes, invoices now show all required details, card surcharges, and failed payment fees as separate line items. This gives you and your clients full transparency into what’s being charged, helping reduce confusion and billing disputes.

What’s New

The following updates now appear on Standard and Failed Payment invoices processed through EzyPay:

-

“Tax Invoice” clearly displayed (for GST-registered businesses).

-

Business name and ABN are clearly displayed.

-

GST amounts are clearly broken out or noted as included.

-

Credit card surcharges appear as a separate line item.

-

Failed payment fees are shown as their own line item with clear labeling.

-

Non-GST registered businesses now see “Regular Invoice” instead of “Tax Invoice.”

-

Load Fees are clearly displayed.

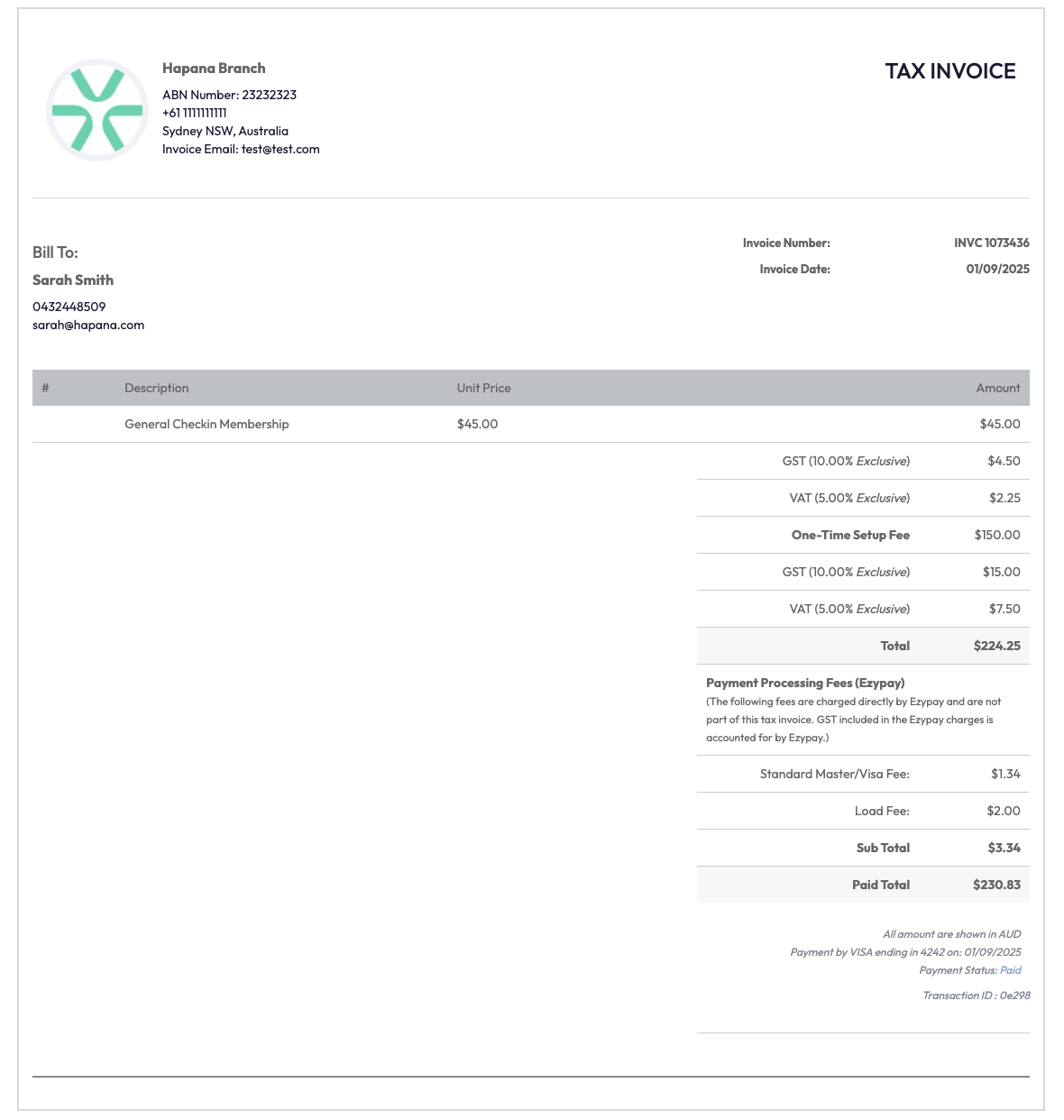

Review a Standard Invoice

1. Open the Invoice

-

Log in to Core.

-

Go to Payments > Retail Dashboard.

-

Select Invoices and open any standard invoice.

2. Check Key Invoice Details

Every Standard invoice displays:

-

Tax Invoice at top

-

Business Name, Business Details and ABN

-

Invoice number and date

-

Description, unit price, and total

-

GST clearly displayed or noted as included

-

Credit card surcharges are listed as a separate line item so you and your client can see exactly how fees are applied

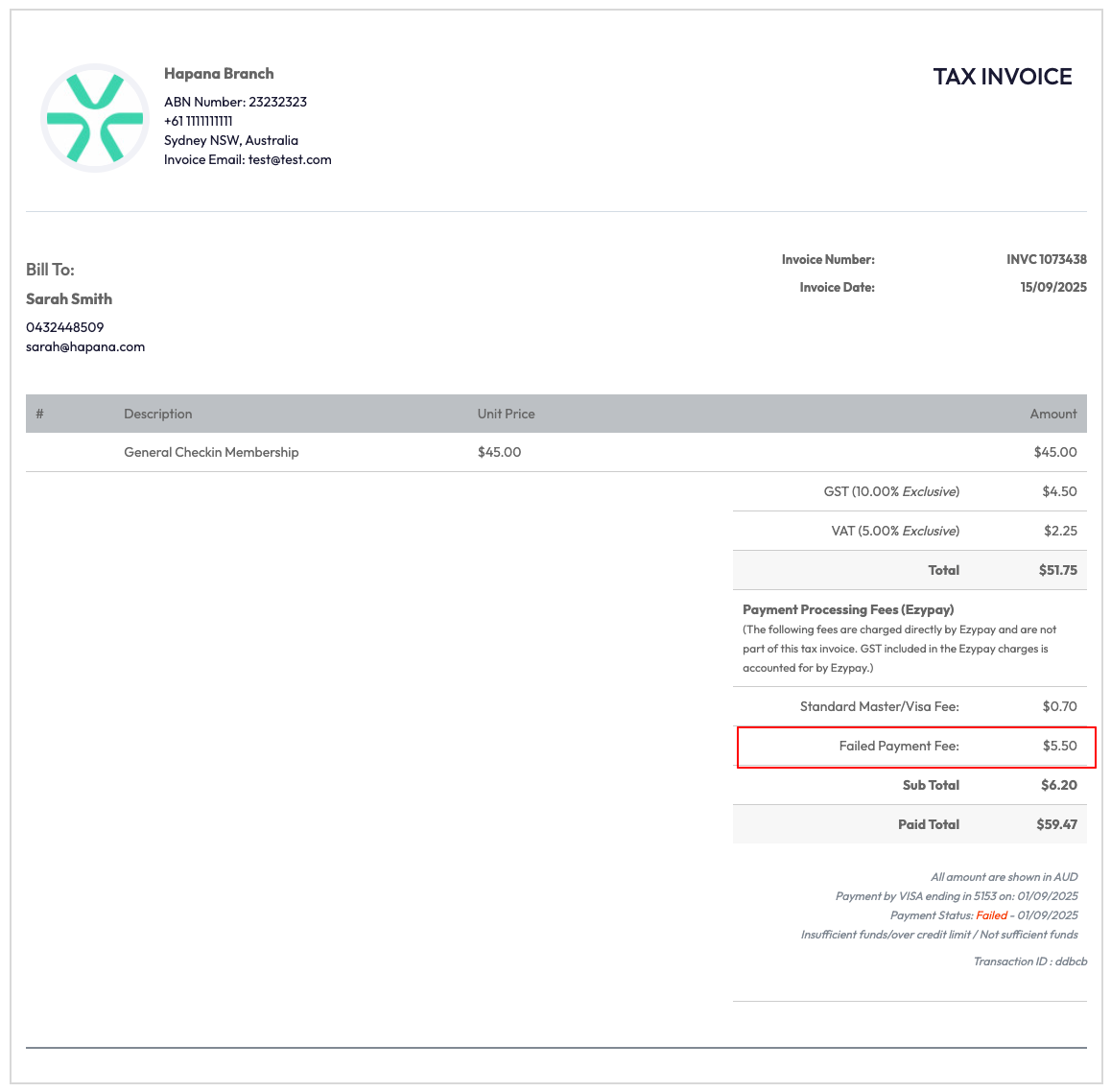

Review a Failed Payment Invoice

1. Locate the Invoice

-

Go to Payments > Retail Dashboard.

-

Select relevant Invoices

2. Check the Fee Display

The invoice will now show a Failed Payment Fee as a separate line item. This makes it clear to your client what fee was charged.

Expected Outcome

After these updates, all standard and failed payment invoices will:

-

Display key business and client details clearly

-

Break down GST amounts properly

-

Show card surcharges and failed payment fees as separate line items

-

Use consistent formatting, reducing confusion and member questions

FAQ

Q: What if my business is not GST registered?

A: Invoices will be labeled “Regular Invoice” instead of “Tax Invoice,” and GST will not be displayed.

Q: How will clients see card surcharges?

A: Card surcharges appear as their own line item on the invoice, and are also disclosed at checkout before payment.

Reach out to our support team via [email protected] if you need help.